capital gains tax increase 2021 retroactive

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan.

Crystal Ball Gazing To The Past Article By Pearson Co

With this retroactive income tax hike the White.

. June 16 2021 Christopher Condon Laura Davison Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective. Bidens announcement of the tax increase as part of his American Families Plan which includes an expanded child tax credit and funding for preschool and community collegeHe detailed the plan April 28 and the budget will be released Friday Richard Rubin of the Journal writes. Earlier this year President Biden proposed a 2022 budget for the federal government along with a Greenbook explaining corresponding proposed changes to the tax code.

Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds. Retroactive Tax Increase. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20.

Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax. The capital gains tax. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

The effective date for the capital-gains tax rate increase would be tied to Mr. Having resolved the infrastructure bill Congress now begins debate and consideration of the budget through a reconciliation process since that can be passed with 50 votes bypassing the normal process that subjects. The Basics For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

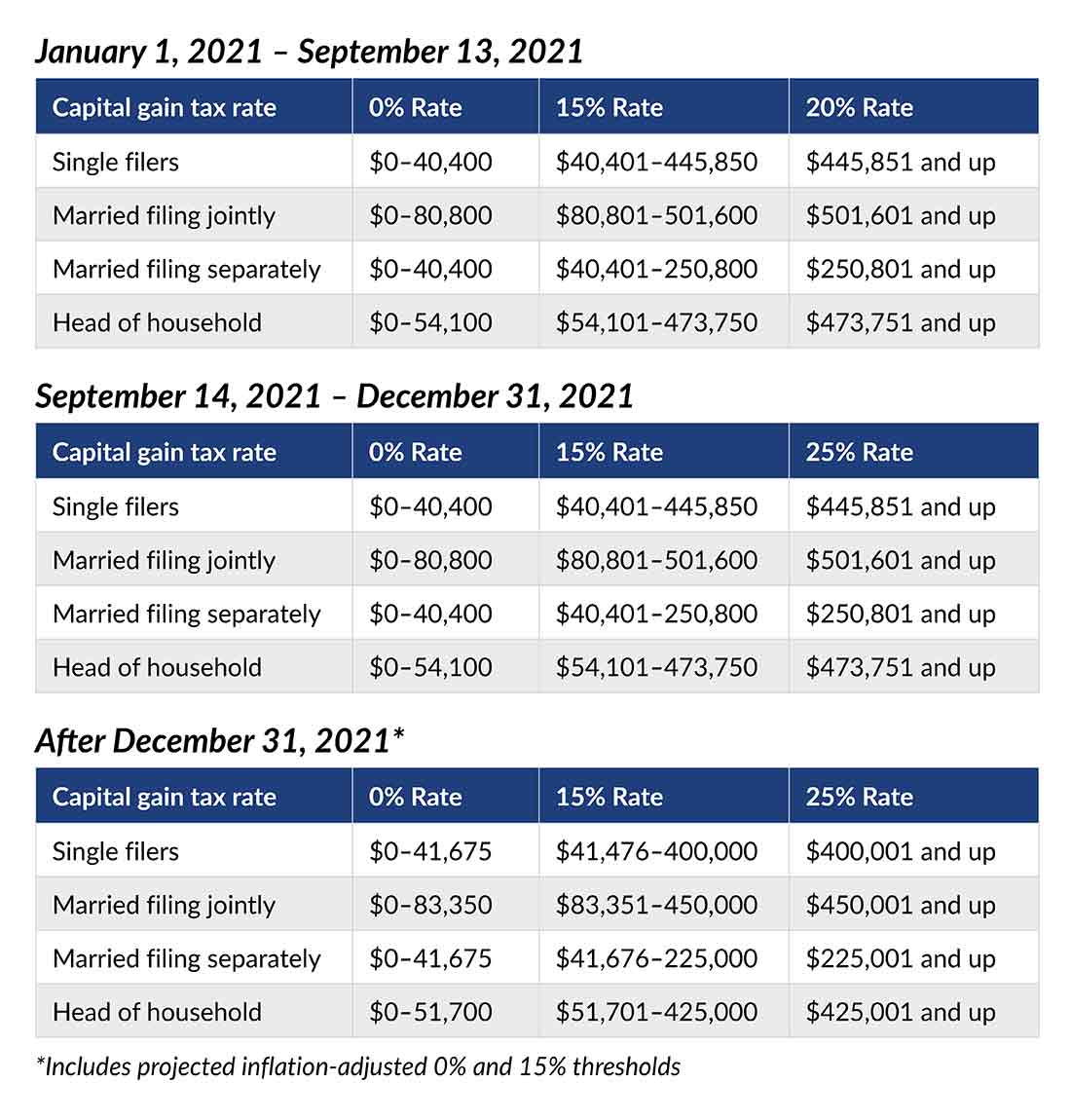

Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. The table also shows the inclusion Eligible.

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect.

AUGUST 11 2021 BYJOE BISHOP-HENCHMAN. Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. If a capital gains increase is imminent which will take effect in 2022 taxpayers should consider sales before the end of the year to take advantage of lower interest rates for 2021.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Bidens Proposed Retroactive Capital Gains Tax Increase Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary.

One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75. TKO Taseko or the Company reports Adjusted EBITDA of 201 million for the full-year 2021 an 85 increase over 2020.

The top rate for 2021. June 16 2021 1108 AM PDT Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that. Year-end planning for 2021 is more challenging than usual due to the uncertainty surrounding pending legislation that could among other things increase top tax rates on ordinary income and capital gains starting next year.

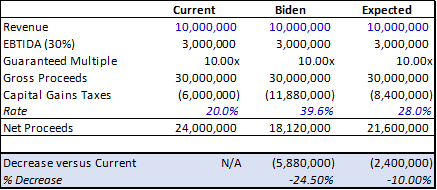

Versions of this article were published by Advisor Perspectives and. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021. The capital gains increase would likely be retroactive for less than a year.

4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the 38 Obamacare tax. 7 rows 2021 federal capital gains tax rates.

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Managing Tax Rate Uncertainty Russell Investments

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

If The Build Back Better Bill Does Pass In 2022 Will The Capital Gains Qsbs Changes Still Be Retroactive To 2021 R Fatfire

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

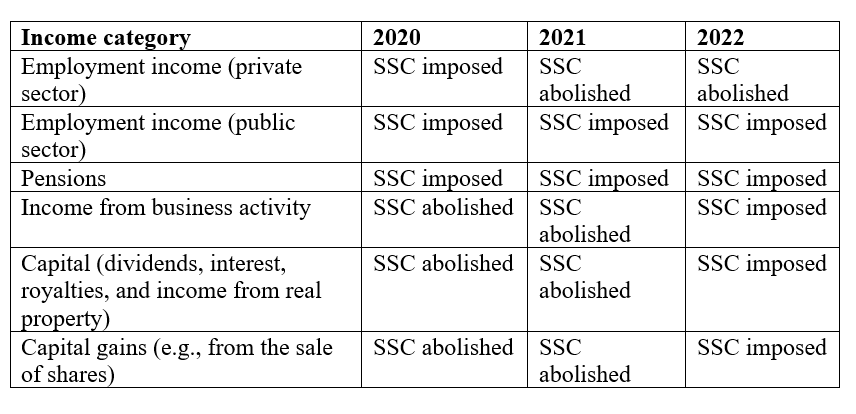

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Retroactive Tax Legislation And Gift Planning In 2021 New Jersey Law Journal

2021 2022 Proposed Tax Changes Wiser Wealth Management

What Can The Wealthy Do About Biden S Proposed Tax Increases

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Tax Implications Of Selling Your Business In 2021 Vs 2022

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others