wealthfront vs betterment tax loss harvesting

Tax Loss Harvesting. Betterment at a glance.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

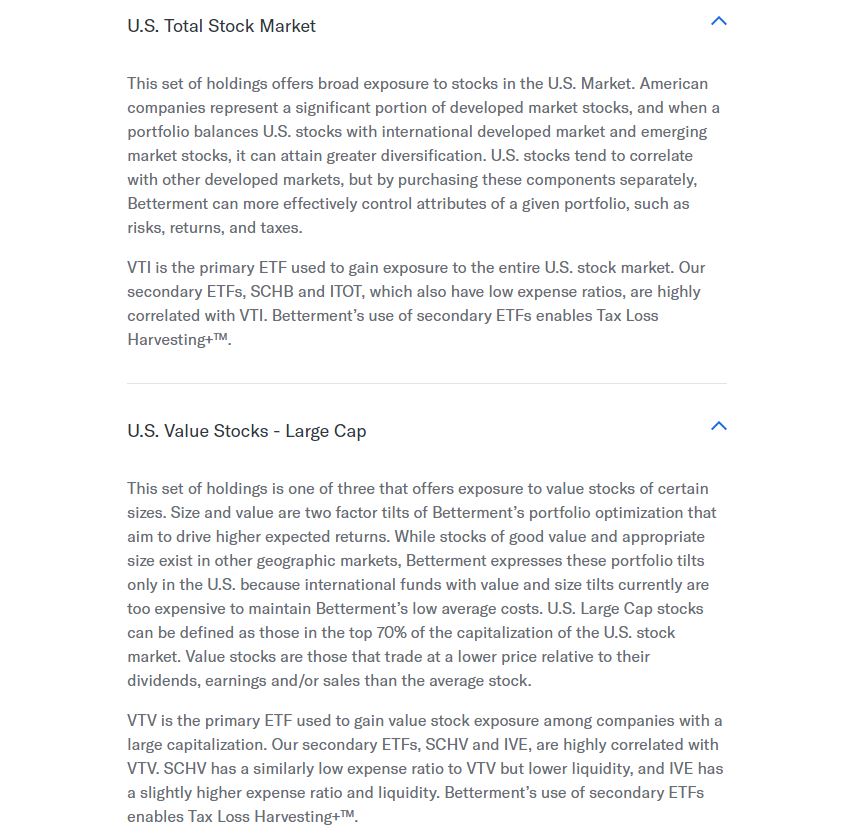

Their methods for tax harvesting.

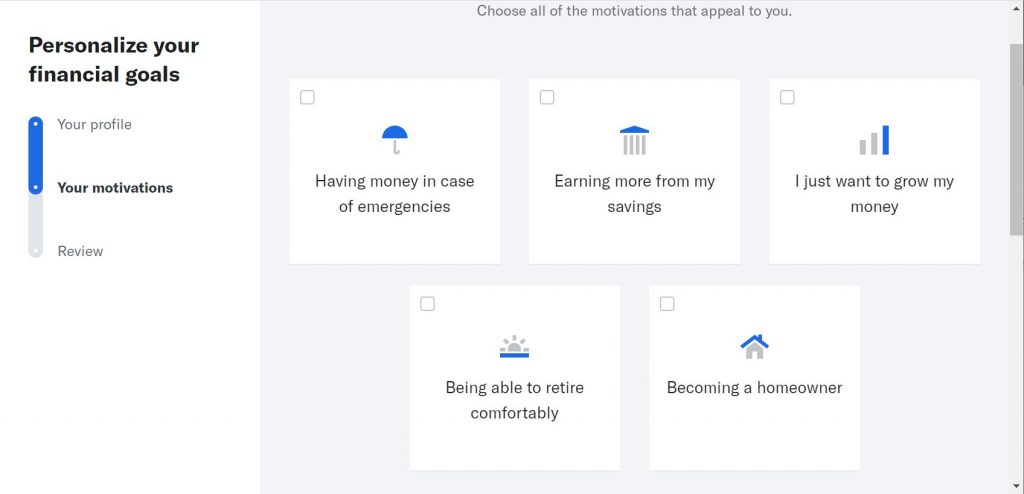

. Ad Automated And Sophisticated Investment Strategies To Optimize Performance At A Low Cost. Both companies offer significant tax strategy programs or tax-loss harvesting to. Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can reduce your tax bill leaving.

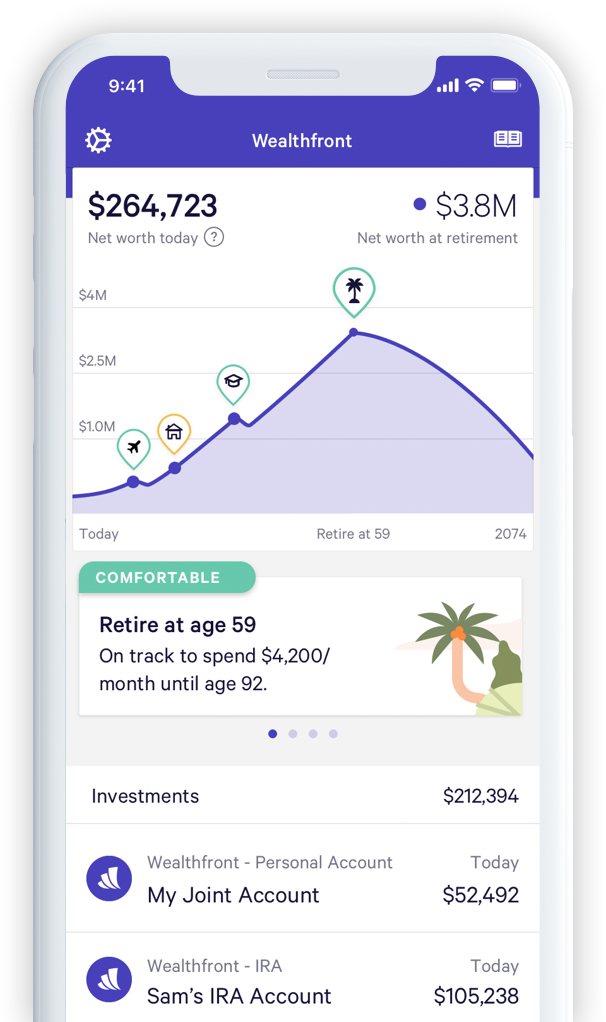

Now that they have Tax loss harvesting feature in both for everyone I need to decide which to move. Ad Tailored portfolio solutions to institutional investing with 150 years of expertise. Wealthfront also offers tax-loss harvesting via direct indexing and automated portfolio rebalancing.

Learn how MetLife Investment Management can help solve your unique investment needs. We Work Closely With You To Create A Personalized Plan To Help You Reach Your Goals. Best of all if you sell more losses than gains you can carry those forward to the following tax year.

Wealthfront offers across-the-board pricing at 025 regardless of portfolio size or plan. Grow Your Long-Term Wealth Effortlessly At A Low Cost. This is free for all.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Discover Which Investments Align with Your Financial Goals. Grow Your Long-Term Wealth Effortlessly At A Low Cost.

Its like regular tax-loss harvesting but instead of investing in only ETFs or index funds it invests in individual stocks in the SP 500. Ad Take Advantage of Fidelitys Wealth Management. If I look at the value prop for Betterment or Wealthfront it seems that I can achieve all of the benefits of their service through Vanguard using Admiral Total Market funds except for tax.

Securities that are sold in tax-loss harvesting are replaced by similar securities in order to maintain the same asset allocation in a portfolio. TurboTax customers can easily import tax-loss harvesting data from. Wealthfront does have a distinct advantage over Betterment because it.

Connect With a Fidelity Advisor Today. Start Your Free Trial. I have around 11000 in both Betterment and Wealthfront.

We saved you 4261 on your taxes with Tax-Loss Harvesting. Ad Our Advisors Are Here To Help You Make Informed Decisions About Your Financial Future. We saved you 953 on your taxes with Tax-Loss Harvesting.

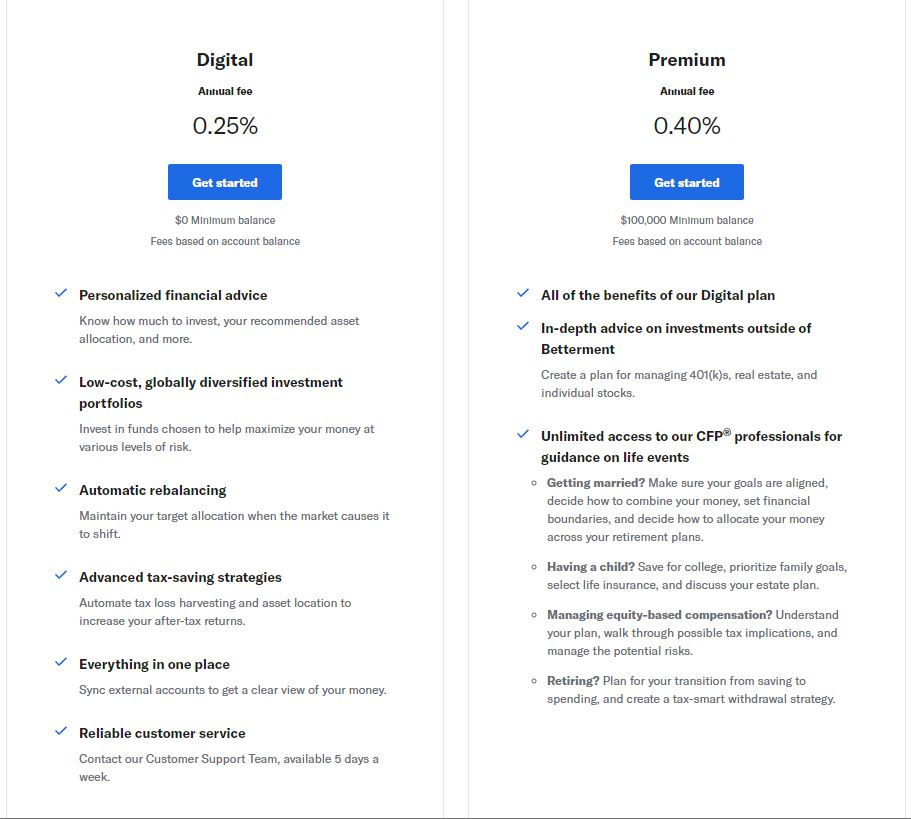

We help lower your taxes. Both Betterment and Wealthfront enable tax-advantaged investing through tax-loss harvesting. Betterment and Wealthfront both charge an annual fee of 025 for digital portfolio management.

Ad Investment Analysis Software Designed For The Way You Work Built On Data And Research. Ad Automated And Sophisticated Investment Strategies To Optimize Performance At A Low Cost. Wealthfront Fees and Plans Betterment.

Ad Financial Security is Attainable. Try Out Our All-In-One Web-Based Platform For Modern Advisors. Betterment vs Wealthfront Tax-loss Harvesting.

Find a Dedicated Financial Advisor Now. Wealthfront avails tax loss Harvesting using your losses to offset taxes that would be levied on your gains to everyone using their platform providing benefits to all users alike. You like a simple fee structure.

They both offer tax loss harvesting. Its also a significant differentiator in the Betterment vs. Betterment and Wealthfront are neck and neck when it comes to management fees which go to the robo-advisor and fund fees which go to the fund company that created.

Wealthfront and Betterment include automatic tax loss harvesting as part of their core service offerings. Tax loss harvesting is an advanced investment strategy that Wealthfront and Betterment have both brought to consumers at no. The Mad FIentist recommends Betterment for the automated tax-loss harvesting.

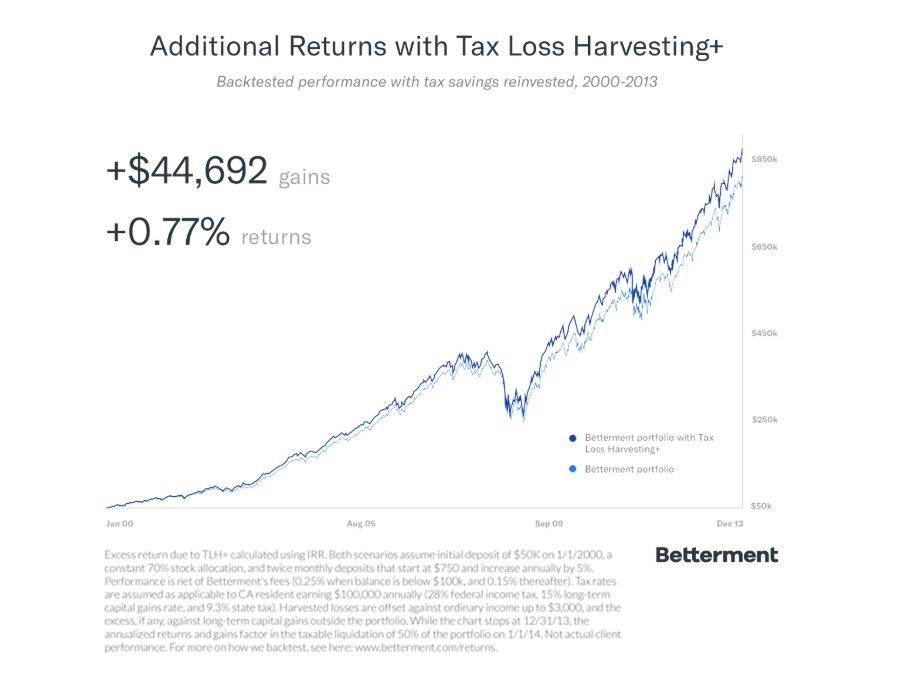

Betterment uses tax-loss harvesting to sell and reinvest any losses into securities that align with your current portfolio. This is unlike Betterment which has a 040 fee on. Betterment and Wealthfront both offer tax.

TLH in Betterment vs Wealthfront. Betterment and Wealthfront are neck and neck when it comes to management fees which go.

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Which Is Better Mustard Seed Money

Betterment Vs Wealthfront Which Robo Advisor Is Best For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

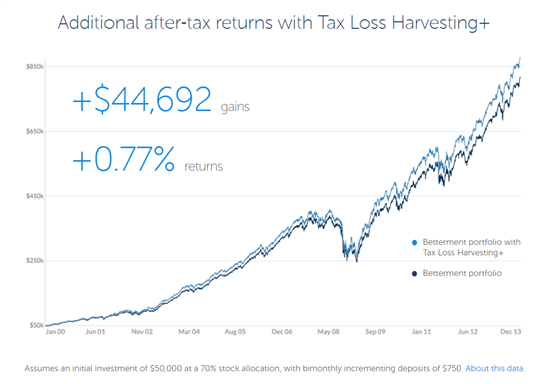

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Vs Acorns Which Robo Advisor Is Best

Wealthfront Vs Betterment Wealthfront

Betterment Vs Wealthfront The Simple Dollar

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Fin Tech Financial Technology Tamkang University Roboadvisors For

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Guide Which Is Right For You Minafi

Which Is Better For Investing Betterment Vs Wealthfront Gobankingrates

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

The 13 Best Robo Advisors For 2022 Pros Cons Top Picks Investinganswers